Paycheck math finance in the classroom is an essential component of financial literacy, equipping individuals with the knowledge and skills to manage their finances effectively. This engaging discipline provides a foundation for understanding paycheck structure, budgeting, taxes, and deductions, empowering students to make informed financial decisions throughout their lives.

Through hands-on exercises and real-world examples, paycheck math finance in the classroom fosters a comprehensive understanding of financial concepts. It cultivates critical thinking, problem-solving abilities, and a sense of financial responsibility, preparing students to navigate the complexities of personal finance in the modern world.

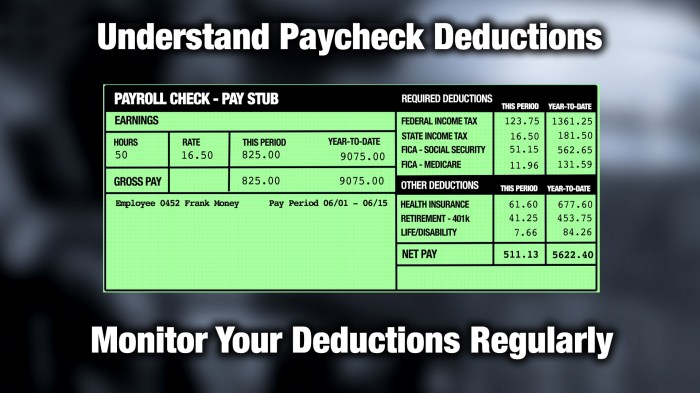

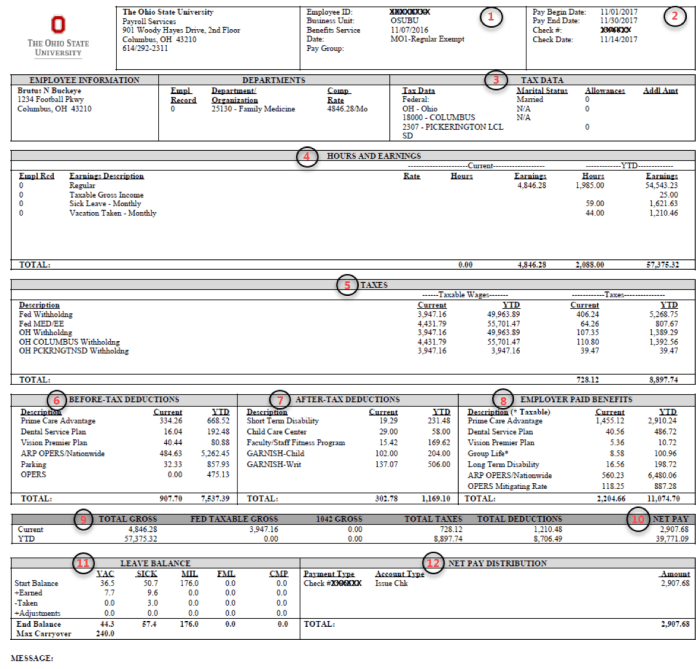

Paycheck Structure and Components

A paycheck is a document that provides an employee with details of their earnings and deductions. It typically includes the following components:

Gross Pay

Gross pay is the total amount of money earned before any deductions are taken out.

Deductions

Deductions are amounts that are withheld from an employee’s gross pay. Common deductions include:

- Taxes (federal, state, and local)

- Health insurance premiums

- Retirement contributions

- Union dues

Net Pay, Paycheck math finance in the classroom

Net pay is the amount of money that an employee receives after all deductions have been taken out.

Understanding each component of a paycheck is important for employees to manage their finances effectively.

Budgeting and Financial Planning

Budgeting and financial planning are essential for individuals to manage their finances and achieve their financial goals.

Budgeting

Budgeting involves creating a plan for how to allocate income to expenses. A budget should align with an individual’s income and expenses.

Financial Planning

Financial planning is the process of creating a long-term plan for managing finances. This includes setting financial goals, creating a budget, and investing for the future.

Paycheck math plays a crucial role in making informed financial decisions by providing individuals with the information they need to create a budget and plan for the future.

Taxes and Deductions: Paycheck Math Finance In The Classroom

Taxes and deductions can significantly impact an employee’s net pay.

Taxes

Common taxes that are withheld from paychecks include:

- Federal income tax

- State income tax

- Local income tax

- Social Security tax

- Medicare tax

Deductions

Common deductions that are withheld from paychecks include:

- Health insurance premiums

- Retirement contributions

- Union dues

- Charitable contributions

Understanding the different types of taxes and deductions is important for employees to calculate their net pay and plan for the future.

Paycheck Math in Practice

Paycheck math involves calculating an employee’s gross pay, deductions, and net pay.

Calculating Gross Pay

Gross pay is calculated by multiplying the employee’s hourly wage by the number of hours worked.

Calculating Deductions

Deductions are calculated by subtracting the amount of each deduction from the employee’s gross pay.

Calculating Net Pay

Net pay is calculated by subtracting the total amount of deductions from the employee’s gross pay.

Performing paycheck math calculations accurately is important for employees to ensure that they are receiving the correct amount of pay.

Financial Literacy and Paycheck Math

Financial literacy is the ability to understand and manage personal finances. Paycheck math contributes to overall financial literacy by providing individuals with the skills to:

- Understand their paychecks

- Create a budget

- Plan for the future

Improving financial literacy skills can help individuals make informed financial decisions and achieve their financial goals.

Commonly Asked Questions

What is the significance of paycheck math finance in the classroom?

Paycheck math finance in the classroom is crucial because it provides students with the foundational knowledge and skills to manage their finances effectively, make informed financial decisions, and achieve financial well-being.

How does paycheck math finance contribute to financial literacy?

Paycheck math finance enhances financial literacy by teaching students about paycheck structure, budgeting, taxes, and deductions. It fosters an understanding of how these concepts impact their financial situation and empowers them to make informed choices.

What are the benefits of incorporating paycheck math finance into the curriculum?

Incorporating paycheck math finance into the curriculum equips students with practical skills that they can apply throughout their lives. It promotes financial responsibility, reduces the likelihood of financial distress, and contributes to overall financial well-being.