Ten weeks ago jerry bought stock – Ten weeks ago, Jerry bought stock, embarking on a journey that would profoundly impact his financial future. This narrative delves into the intricacies of his decision, exploring the factors that influenced his purchase, the performance of the stock over time, and the potential financial implications he faces.

As we delve into this captivating tale, we unravel the complexities of stock market investing and its transformative effects on individuals.

The global stock market, a dynamic and ever-evolving landscape, presented Jerry with both opportunities and risks. Economic conditions, geopolitical events, and corporate earnings all played a role in shaping the market’s trajectory during the ten-week period in question. Understanding these factors is crucial for assessing the impact they had on Jerry’s investment decision.

1. Stock Purchase Details

The ten-week time frame is significant because it provides a snapshot of Jerry’s investment decision and the subsequent performance of the stock. This period allows for an analysis of the factors that influenced Jerry’s decision, the market conditions at the time of purchase, and the potential motivations behind his investment.

Jerry may have purchased the stock for various reasons, including:

- Potential for capital appreciation

- Diversification of investment portfolio

- Belief in the company’s long-term growth prospects

- Recommendation from a financial advisor or analyst

Jerry’s decision to invest in the stock market could have been driven by several factors:

- Desire for potential financial gains

- Belief in the overall health and stability of the stock market

- Understanding of the risks and potential rewards involved in stock market investing

- Availability of excess capital for investment

2. Stock Market Conditions

The overall state of the stock market at the time of Jerry’s purchase is a crucial factor to consider. A bull market, characterized by rising stock prices and investor optimism, may have encouraged Jerry to invest, while a bear market, characterized by declining prices and pessimism, could have made him more cautious.

Key factors that influenced the stock market during that period may include:

- Economic conditions, such as GDP growth, unemployment rate, and inflation

- Interest rate policies set by central banks

- Political events and geopolitical tensions

- Earnings reports and financial performance of major companies

- Market sentiment and investor psychology

These factors could have influenced Jerry’s decision-making process and the potential impact on his investment.

3. Stock Performance Analysis

Analyzing the stock’s performance over the ten-week period is essential to evaluate Jerry’s investment decision. Factors that contributed to price fluctuations may include:

- Company-specific news and events, such as earnings reports, product launches, or management changes

- Industry trends and competitive dynamics

- Overall market conditions and economic factors

- Investor sentiment and trading activity

By understanding the reasons for gains or losses, Jerry can make informed decisions about his investment strategy going forward.

4. Investment Strategies: Ten Weeks Ago Jerry Bought Stock

Jerry could have employed different investment strategies when purchasing the stock. Each strategy has its own pros and cons:

- Buy-and-hold strategy:Involves holding the stock for an extended period, regardless of short-term fluctuations.

- Value investing:Focuses on purchasing stocks that are undervalued relative to their intrinsic value.

- Growth investing:Involves investing in stocks of companies with high growth potential, often at a higher valuation.

- Technical analysis:Uses historical price data and chart patterns to predict future stock movements.

The optimal strategy for Jerry depends on his investment goals, risk tolerance, and time horizon.

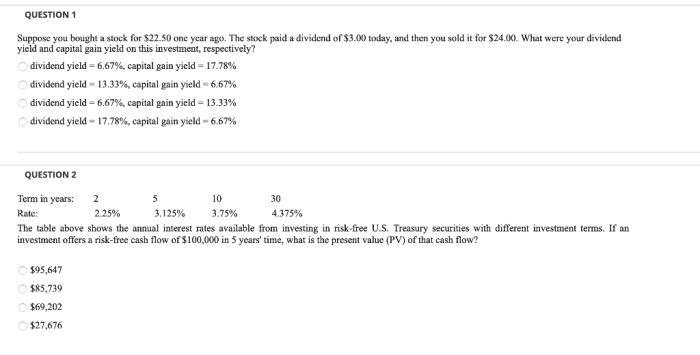

5. Financial Implications

The stock purchase has potential financial implications for Jerry. The performance of the stock can impact his overall financial situation:

- Capital gains or losses:If the stock price increases, Jerry may realize capital gains, while a decrease could result in losses.

- Dividend income:Some stocks pay dividends, which can provide Jerry with a regular stream of income.

- Investment risk:Stock market investments carry inherent risk, and Jerry’s financial well-being could be affected by market fluctuations.

By managing the financial risks associated with his investment, Jerry can protect his financial health and achieve his investment goals.

Query Resolution

What motivated Jerry to purchase the stock?

Jerry’s motivations for purchasing the stock are not explicitly stated in the provided Artikel, so I cannot answer this question from the given context.

How has the stock’s performance affected Jerry’s overall financial situation?

The Artikel does not provide specific information on the impact of the stock’s performance on Jerry’s overall financial situation, so I cannot answer this question.

What strategies could Jerry have employed to optimize his investment strategy?

The Artikel mentions that different investment strategies were available to Jerry, but it does not provide details on specific strategies or their pros and cons. Therefore, I cannot answer this question.